Introduction

When you open your federal student aid offer, you’ll likely see two types of loans: subsidized loans and unsubsidized student loans. Most students accept both without fully understanding the difference. That’s a costly mistake. Unsubsidized loans start charging interest the day they’re disbursed—even while you’re in school.

Before you click “accept,” you need to know exactly what you’re signing up for and whether it’s the right choice for your situation. This guide breaks down how unsubsidized student loans work, what they’ll actually cost you, and when they make sense to take.

What Is an Unsubsidized Student Loan?

An unsubsidized student loan is a federal loan available to undergraduate and graduate students regardless of financial need. Unlike subsidized loans, the government does not pay the interest while you’re in school, during grace periods, or deferment.

Interest begins accumulating from the moment your school receives the funds. If you don’t pay it while you’re enrolled, it capitalizes—meaning unpaid interest is added to your principal balance. You’ll then pay interest on that new, higher amount.

Interest Rates (2025–2026):

- Undergraduate: 6.53%

- Graduate: 8.08%

These rates are fixed for the life of the loan.

How Unsubsidized Student Loans Work in Real Life

Here’s what happens when you take out an unsubsidized student loan:

- While in school

- Interest accrues daily based on your loan balance.

- You can pay it monthly to keep your balance from growing or let it accumulate.

- After graduation

- You enter a six-month grace period. Interest continues to accrue.

- When repayment begins, unpaid interest capitalizes and becomes part of your principal.

Example:

- Borrow $10,000 at 6.53% interest as a freshman.

- Do not pay anything for four years. By graduation, you’ll owe ≈ $12,900.

- Over a 10-year repayment term, total interest ≈ $4,400.

- Paying interest during school (~$54/month) saves $1,500+.

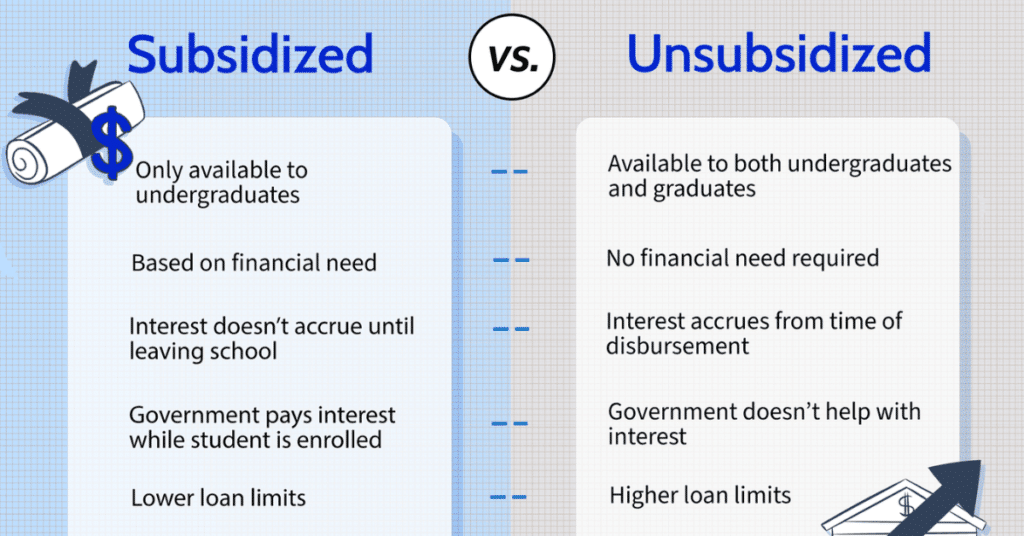

Difference Between Subsidized and Unsubsidized Student Loans

| Feature | Subsidized Loan | Unsubsidized Loan |

| Eligibility | Based on financial need | No financial need requirement |

| Who can apply | Undergraduates only | Undergrads & graduates |

| Interest during school | Government pays it | Borrower responsible |

| Interest during grace period | Government pays it | Borrower responsible |

| Annual borrowing limits | Lower ($3,500–$5,500) | Higher ($5,500–$20,500) |

| Long-term cost | Lower total interest | Higher total interest |

Key takeaway: Subsidized loans save thousands in interest; unsubsidized loans put responsibility entirely on you.

Pros and Cons of Unsubsidized Student Loans

| Pros | Cons |

| Available to all students regardless of income | Interest starts immediately |

| Fixed interest rates (predictable payments) | Interest capitalizes if unpaid |

| No credit check or cosigner required | Can lead to higher total debt |

| Six-month grace period after graduation | Graduate rates are significantly higher |

| Income-driven repayment options | Easy to overborrow without realizing cost |

Summary: Unsubsidized loans offer access to education funding without restrictions—but convenience comes at a real cost. The longer you wait to pay interest, the more expensive your loan becomes.

Should You Accept an Unsubsidized Student Loan?

YES, if:

- You’ve maxed out subsidized loans and still need funding.

- You have no better options (grants, scholarships, work-study).

- You can afford to pay interest while in school.

- Your degree leads to reliable income that justifies the debt.

- You borrow only what you truly need for tuition and essentials.

NO, if:

- You haven’t exhausted free money (FAFSA, grants, scholarships).

- You’re using it for non-essentials like a vacation or gadgets.

- You are uncertain about finishing your degree.

- You already have significant debt and minimal job prospects.

- You can cover costs through part-time work or family support.

Smart approach: Accept only what you need after scholarships and grants. If you must take unsubsidized loans, treat the interest seriously from day one.

Common Mistakes to Avoid

- Ignoring interest while in school – Interest accumulates silently; small payments prevent thousands in capitalized interest.

- Borrowing the full amount offered – Take only what’s needed for tuition, fees, books, and living essentials.

- Not understanding capitalization – Unpaid interest added to principal increases long-term repayment by 20–30%.

- Accepting loans before checking other options – FAFSA, scholarships, and work-study always come first.

- Treating all federal loans the same – Subsidized loans are always better if eligible.

Frequently Asked Questions (FAQs)

Q1. Do you have to pay back unsubsidized student loans?

Yes. These are borrowed funds that must be repaid with interest. Repayment starts six months after graduation, leaving school, or dropping below half-time enrollment.

Q2. Is an unsubsidized loan bad for students?

Not inherently, but it’s more expensive than subsidized loans because interest accrues immediately. Manage carefully by paying interest during school.

Q3. Should I accept a subsidized or unsubsidized loan first?

Always accept subsidized loans first. Only take unsubsidized loans after maxing out free aid options.

Q4. When does interest start on unsubsidized loans?

Interest starts the day your school receives the funds—continues during enrollment, grace periods, and deferment unless paid.

Q5. Can you pay interest while in school?

Yes, and it’s recommended. Prevents capitalization and keeps your loan manageable.

Q6. What happens if I don’t pay interest during school?

Unpaid interest capitalizes at the end of the grace period, increasing your principal and long-term repayment costs.

Expert Tips for Managing Unsubsidized Loans

- Pay interest during school ($25–50/month can save thousands).

- Borrow by semester, not by year, to avoid unnecessary debt.

- Track total borrowing via NSLDS to make informed decisions.

- Consider paying during grace period if financially possible.

Final Thoughts

Unsubsidized student loans are a helpful funding option when used responsibly. Prioritize subsidized loans, grants, and scholarships first. Borrow only what you truly need, and start paying interest early to reduce costs. Careful planning ensures your student loans support your education without creating long-term financial strain.